UCL’s investment portfolio reveals they hold shares in a tech company working directly with the Israeli police force since as early as 2020.

This presents a potential violation of their own Socially Responsible Investment Policy as leading human rights organisations, including Human Rights Watch and Amnesty International, have accused Israel Police of human rights violations and discriminatory behaviour towards Palestinian activists.

The latest report on UCL’s investment portfolio shows that the university has been investing in NICE Ltd., a company which produced recording systems used by Israel Police.

A public bidding process to take over responsibility of these systems by Israel Police confirms the existence of this equipment, which is now managed by their partner-company Bynet.

UCL maintains two investment portfolios with CCLA and Cazenove Capital, asset managers specialising in the charities sector, last valued at £130 million and £119 million respectively. CCLA and Cazenove Capital are responsible for the management and direction of funds within these portfolios, publishing a report after the conclusion of each financial year.

These are a collection of investments owned by UCL, but the asset managers are responsible for the stocks, shares, or financial products. Decisions are made based on UCL’s investment policy and their self-imposed criteria for investment.

In April 2020, UCL approved the latest version of their investment policy which outlines their criteria for deciding which companies to invest in. This includes clauses aiming to minimise and eliminate investments in the tobacco industry, climate risks, discrimination, arms sales, and human rights violations.

NICE Ltd. was founded in Israel by former members of the IDF’s Intelligence Corps but moved its headquarters to the United States in 2015. It has been publicly traded on the NASDAQ stock exchange since 1996.

The company has a history of involvement with the Israeli arms industry but has since pivoted to marketing its AI and Customer Experience products. In 2003, it sold its Military Intelligence unit to defence company ELTA, and in 2015 sold its Cyber Intelligence unit to Elbit Systems, Israel’s largest military manufacturer.

Protests by pro-Palestinian activists occurred earlier this year in Glasgow over use of the company’s CCTV systems by the City Council.

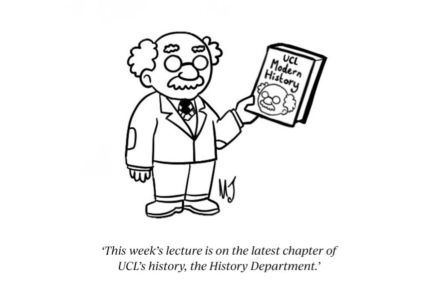

Previous reporting on UCL’s investment practices has been inconsistent. The activist group Palestine Solidarity Campaign runs a “University Complicity Database” on their website. They allege that UCL has over £13 million in what they call “Complicit Funds” based on companies with indirect links to Israel’s government or defence companies.

However, this was built on Freedom of Information requests that are sent to all universities on a bi-annual basis. These requests lack a number of details on UCL’s portfolio and claims the university has no ethical investment policy, which is untrue.

As an exempt charity, UCL is not legally required to provide more than an annual audited statement for the financial year and forecast data to the Office for Students (OfS), its principal regulator.

The OfS does not publicly provide specific guidance institutions over the treatment of investment portfolios, a practice that is common in higher education as a means of building financial stability and additional revenue.

Many institutions like UCL have implemented self-imposed investment policies as a means of demonstrating accountability and integrity as a business, particularly on issues such as net-zero and climate commitments.

UCL does not publish its full financial strategy, only providing an executive summary on its website. CCLA, who manage the shares, state they focus on Environmental, Social and Governance (ESG) risks in investment decisions.

ESG investing is a trend in the financial world that encourages investors to consider a company’s commitment to socially responsible behaviours alongside traditional financial analysis, such as net-zero or diversity, equity, and inclusion policies.

This is applied through examining multiple business aspects such as products, external commitments, and internal workplace practices. NICE has been able to pass CCLA’s criteria for investment. However, their association with Israeli government bodies, in particular the police force who operate in occupied territories, could be a violation of UCL’s third criterion for socially responsible investment: avoiding investments in companies committing human rights abuses.

Decisions are taken by UCL’s Investments Committee, consisting of external members and members of staff, with the President of the Students Union listed as an observer.

The Students’ Union is a separate entity to UCL and has its own board of trustees who manage its finances. Information for the financial year which has just passed is due to be published before the 31st of December.

A UCL spokesperson said:

“We have an ethical investment policy which sets out red lines in relation to companies in which we will not invest. Nice Ltd fully complied with this policy.

“Our two fund management companies are both signatories of the UN Six Principles for Responsible Investment. Our policy on ethical investment is overseen by the Investments Committee of our governing body, UCL Council, which includes student representation.”